1. Acknowledgements

Authors: Sami Hamroush, Ciaren Taylor, Matthew Luff, Philip Wales, and Michael Hardie.

The authors would like to acknowledge the contributions from Claire Dobbins, Chloe Gibbs, Rachel Jones, Alasdair Henderson, Laura Pullin, Rebecca Hendry and Euan Ritchie.

Nôl i'r tabl cynnwys2. Main Points

The UK’s current account balance has remained in deficit for over three decades1. Between 1999 and 2005 the deficit narrowed from 2.5% to 1.2% of nominal GDP, before widening in the years leading up to the 2008-09 economic downturn, reaching 3.6% of GDP in 2008. Following the downturn, the balance began to narrow, but since 2011 the current account deficit has increased in all years, reaching a record 5.1% of GDP in 2014

The recent deterioration in the current account can be largely explained by the decline in net FDI earnings: FDI accounted for 79% of the £66 billion decline in the primary income balance between 2011 and 2014. This can be attributed to a steady decrease in the value of UK earnings on investments abroad (credits) and foreign earning on investments in the UK (debits), however, the latter increased markedly in 2014

The decline in UK credits from £105 billion in 2011 to £73 billion in 2014 can be attributed to a fall in the rate of return received2 on UK assets – from 8.1% in 2011 to 5.9% in 2014. The remainder of the decline is accounted for by a reduction in the stock of UK assets, which fell by 5.4% over the period. The fall in credits was broad based across all geographic regions; however, the most notable fall came from OECD Ex countries, where credits fell from £40 billion to £23 billion over the period

In contrast, the rate of return on UK liabilities has remained broadly stable, with the increase in UK debits attributable to a 39% increase in the stock of liabilities. The increase in debits was mainly focused in OECD Ex3 countries – with debits in all other regions (G7, emerging markets, and other) remaining broadly stable

Experimental statistics presented suggest that up to 42% of UK assets based in the Netherlands and Luxembourg, and 66% of the credits they generate, are based elsewhere in the world when analysed by the ultimate destination of investment

The distribution of rates of return are analysed over time - the rate of return of the highest performing 30% of UK FDI assets were broadly unchanged between 2009-11 and 2012-14, and the decline is mainly concentrated to the centre and lower end of the distribution. By contrast, the rate of return on the UK’s highest performing liabilities fell over the same period

The three industry groups mainly responsible for the deterioration in net FDI earnings since 2011 were production (from £35 billion to £10 billion); transport, storage & communication (£6 billion to -£7 billion); and distribution, hotels & restaurants (-£0.2 billion to -£12 billion)

The change in UK credits and debits can also be analysed by firm size4. Both credits and debits have been impacted by the largest 5% of firms; these largest firms contributed £22 billion to the overall decline in credits between 2011 and 2014, or 69% of the total decline in credits. The largest firms also contributed £16 billion of the increase in debits, or 83% of the increase

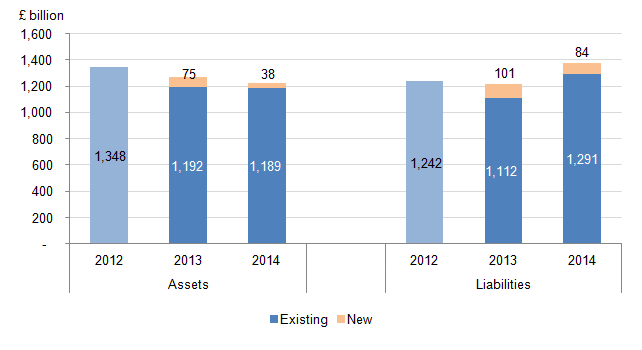

The change in the stock of UK assets and liabilities can be analysed by the change in the existing stock and new investment being undertaken. The fall in UK assets since 2012 can be attributed to a fall in the value of existing assets (£1,348 billion to £1,189 billion), partly offset by new FDI being undertaken in 2013 (£75 billion) and 2014 (£38 billion). In contrast, the increase in UK liabilities is due to both an increase in the value of the existing stock (£1,243 billion to £1,291 billion) and new FDI being undertaken in 2013 (£101 billion) and 2014 (£84 billion)

If the impacts of exchange rates are controlled for from 2006 onwards, the broad trends observed in both UK assets and liabilities, and credits and debits, are still evident. Examining a hypothetical where all UK assets and liabilities are held in foreign currencies, the net International Investment Position (IIP) would still turn negative in 2013 and the gap between credits and debits would still narrow from 2011 onwards

Notes for Main Points

The UK’s last current account surplus was in 1983.

Calculated in this article as credits divided by assets and debits divided by liabilities.

Defined in this paper as OECD member states excluding those belonging to the G7 or emerging markets. See annex for detailed list.

Very large firms are defined as the top 5% of firms by net book value of FDI, large firms as between 95% and 75%, medium firms as between 75% and 25%, and small firms below 25%

3. An Introduction to FDI

Foreign Direct Investment (FDI) refers to cross-border investments made by residents and businesses from one country into another, with the aim of a establishing a lasting interest in the company receiving investment. Ownership of at least 10% of the voting power, representing the influence by the investor, is the basic criterion used (OECD Factbook, 2013).

The importance of FDI has grown rapidly in recent decades, due to ever increasing globalisation. The role FDI plays in establishing lasting links between economies, technological transfers, innovation, and providing investors’ access to previously inaccessible markets, has resulted in FDI becoming a key policy focus for many governments.

FDI statistics published by Office for National Statistics (ONS) cover all cross-border transactions: earnings, positions, and flows. FDI earnings refer to the earnings investments generate: these are referred to as credits for earnings on UK assets abroad, and debits for earnings made by a non-resident enterprises on assets held in the UK. Investment positions refer to the value of the stock of cross-border investment: UK owned assets abroad are referred to as UK assets; assets held in the UK by non-resident enterprises are described as UK liabilities. FDI flows refer to the financial flows from one country to another; these are mainly reflected in the change in investment position, and therefore will not be covered extensively this analysis.

In addition to the range of statistics available on FDI, FDI statistics can be presented using two different principles: the asset & liability principle and directional principle. The asset & liability principle is the recommended international standard for FDI statistics and is used for this paper, as per IMF’s Balance of Payments and International Investment Position Manual, 6th Edition (BPM6). ONS present FDI statistics using this principle in the Balance of Payments, Pink Book and future FDI publications. Further details relating to the differences between the two principles can be found in this OECD paper.

This article focuses predominantly on direct investment income and its recent impact on the UK current account. The ONS plans to publish further analysis in late November 2015 focusing on the UK’s overall International Investment Position (IIP), which will decompose IIP into assets and liabilities, types of investment (focusing on portfolio and other investment), and a breakdown of changes, as well as looking into risk.

Nôl i'r tabl cynnwys4. FDI and the Current Account

It is useful to understand FDI statistics in the context of a country’s economic accounts to help understand its impact on the overall economy. FDI statistics feed into three main parts of National Accounts: FDI earnings are part of direct investment in the primary income account, which is a component of the overall current account; FDI positions are part of the International Investment Positions (IIP); and FDI flows are part of the Financial Account.

A country’s current account measures the domestic economy’s international transactions with the rest of the world, and includes trades in goods & services; primary income, which includes FDI; and secondary income. The sum of the current and capital account determines whether a country is a net lender (surplus) or net borrower (deficit). Note that given small size of capital account, it is the current account that dominates.

The UK’s current account balance has remained in deficit for over three decades1, as Figure 1 illustrates. The period between 1999 and 2005 saw the deficit narrow from 2.5% to 1.2% of GDP, before widening in the years leading up to the 2008-09 downturn, reaching 3.6% of GDP in 2008. The balance began to improve soon after the 2008-09 downturn, narrowing to 1.7% in 2011.

Figure 1: UK current account balance

UK, 1984 to 2014

Source: Office for National Statistics

Download this chart Figure 1: UK current account balance

Image .csv .xlsMore recently, the current account deficit deteriorated in all years between 2011 and 2014, reaching 5.1% of GDP in 2014, as seen in Figure 2. The deficit in 2014 was the largest on record, with the deterioration during this period largely explained by the decline in net FDI earnings: FDI accounted for 79% of the £66 billion decline in the primary income balance between 2011 and 2014.

Figure 2: UK current account balance and components

UK, 2011 to 2014

Source: Office for National Statistics

Download this chart Figure 2: UK current account balance and components

Image .csv .xlsThe deterioration in net FDI earnings reflects movements in the amount of credits the UK generates on its overseas investments, and the debits it pays overseas investors who own UK based assets. The amount of credits the UK generates from its overseas investments has fallen by 31% between 2011 and 2014 to £73 billion, as shown by the blue bars in Figure 32. The majority of this fall occurred in 2012 and 2013, when FDI credits fell by 17% and 14% respectively. FDI credits fell further in 2014, but at a slower rate of 4%.

Figure 3: UK FDI earnings

UK, 2011 to 2014

Source: Office for National Statistics

Download this chart Figure 3: UK FDI earnings

Image .csv .xlsOn the liabilities side, debits increased by 38% between 2011 and 2014 to £71 billion, as illustrated in Figure 3. The majority of this increase occurred in 2014, when debits increased by 25%, though debits also rose in 2012 (2%) and 2013 (8%).

The overall effect of the decline in credits and rise in debits was a reduction in the UK’s overall net FDI earnings from £54 billion in 2011 to £2 billion in 2014. This is the lowest level on record and removes the upward pressure direct investment had historically applied in the UK’s primary income account.

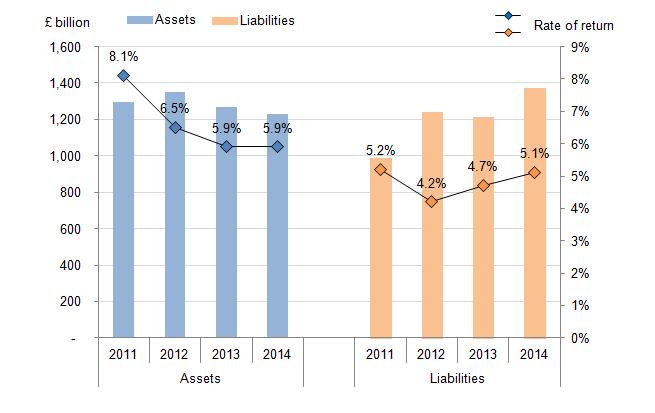

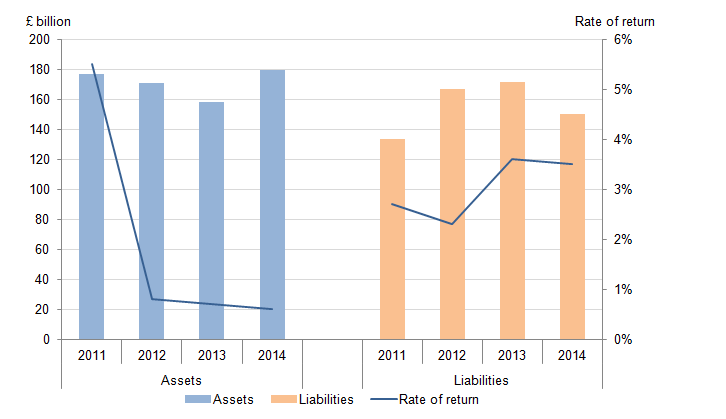

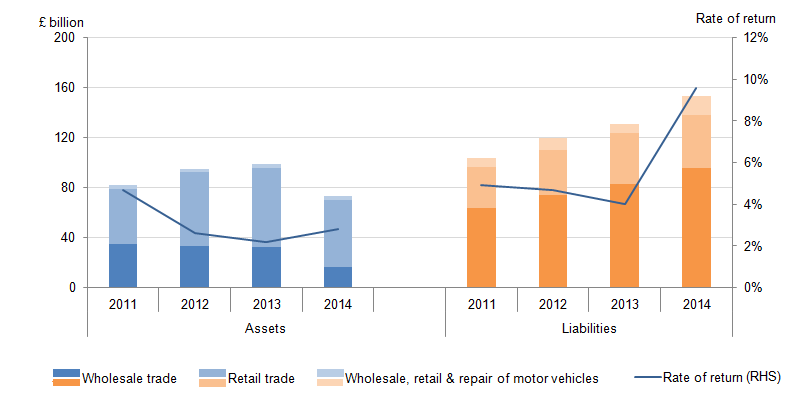

Changes in FDI earnings can reflect a change in the rate of return3, a change in the stock of investment that generates earnings, or a combination of the two. Figure 4 presents the UK’s stock of assets & liabilities and those stocks’ rates of return. As shown by the blue line, in Figure 4 the rate of return the UK generated on its overseas assets fell from 8.1% to 5.9% between 2011 and 2014. The decline in the rate of return generated by assets accounted for 82% of the decline in credits, when compared to a counterfactual world where the UK maintained its 2011 rate of return in 2014. The remainder of the decline in UK credits is accounted for by the decline in assets, which fell by 5.4% between 2011 and 2014 (despite experiencing an increase in 2012).

Figure 4: UK FDI positions and rates of return

UK, 2011 to 2014

Source: Office for National Statistics

Download this image Figure 4: UK FDI positions and rates of return

.png (21.3 kB) .xls (18.4 kB)In contrasts to assets, the rate of return on liabilities has been more resilient, falling just 0.1 percentage points between 2011 and 2014 to 5.1%. The decline in the rate of return indicates the increases in UK debits were due to a 39% increase in the stock of liabilities between 2011 and 2014, with the fall in the rate of return offsetting the increase slightly.

Notes for FDI and the Current Account

The UK’s last current account surplus was in 1983

Debits multiplied by -1

Calculated in this article as credits divided by assets and debits divided by liabilities

5. FDI by Economic Region

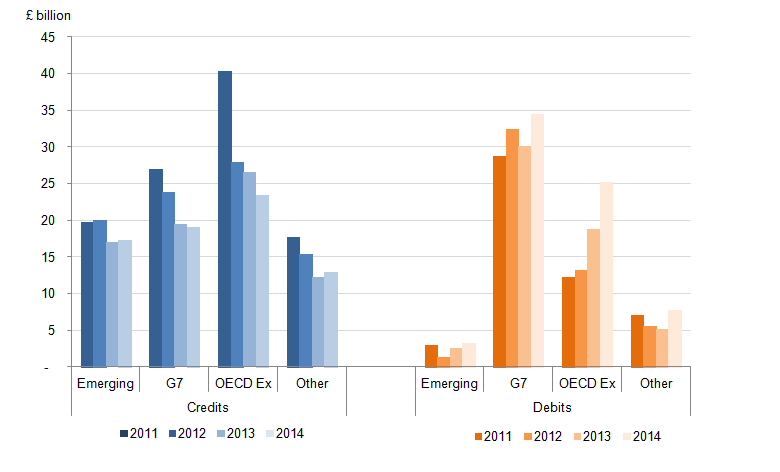

Figure 5 breaks down the fall in UK credits and debits by economic region1.

UK credits fell from £105 billion in 2011 to £73 billion in 2014 – this was broad based, with UK credits from all regions falling. The most notable fall was in OECD Ex countries, where credits fell from £40 billion to £23 billion. Credits from the G7 also experienced a notable fall between 2011 and 2013, although remained stable in 2014.

UK debits increased marginally from £51 billion in 2011 to £57 billion in 2013, before experiencing a large increase to £71 billion in 2014. When broken down by region this produces a mixed picture - debits from G7 economies, emerging markets2 and other countries remained broadly stable between 2011 and 2014, with slight positive and negative variations in 2012 and 2013. However, debits received by OECD Ex countries have increased markedly from 2012 onwards, from £12 billion to £25 billion in 2014.

Figure 5: UK FDI credits and debits by economic region

UK, 2011 to 2014

Source: Office for National Statistics

Download this image Figure 5: UK FDI credits and debits by economic region

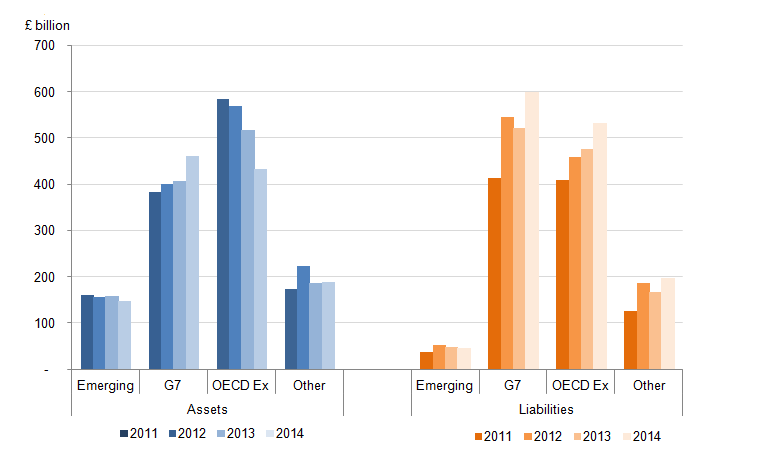

.png (22.0 kB) .xls (18.4 kB)The fall in credits from OECD Ex countries can partly be explained by a reduction in the stock of investment held, which fell from £583 billion in 2011 to £432 billion in 2014, shown in Figure 6. With the exception of an increase in the assets held by the UK in G7 countries in 2014, the investment position in other regions has remained stable.

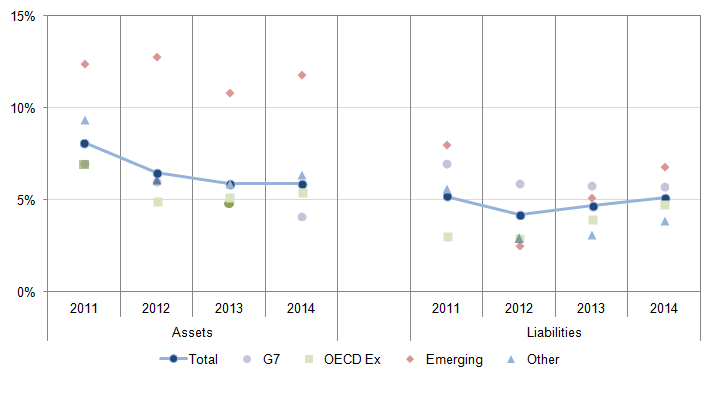

However, UK assets in all regions have experienced a reduction in the rate of return received, shown in Figure 7. The rate of return for all UK assets fell from 8.1% in 2011 to 6.5% in 2012, before stabilising at 5.9% in 2013 and 2014. The G7 and OECD Ex regions, the UK’s largest investment partners, experienced a fall in the rate of return from 7.0% to 4.1%, and 6.9% to 5.4% respectively between 2011 and 2014. Emerging markets continue to provide the UK with the highest rate of return; however, this has slowed slightly over the period from 12.4% to 11.8%.

The increase in UK debits can be attributed to UK liabilities increasing between 2011 and 2014. All economic regions experienced a notable increase in their investment positions in the UK – particularly the G7, OECD Ex and other economies, where UK liabilities grew by £186 billion, £122 billion, and £72 billion respectively.

This increase in UK liabilities has been coupled with a more resilient rate of return, compared to UK assets. The rate of return for UK liabilities fell from 5.2% in 2011 to 5.1% in 2014, with a fall to 4.2% in 2012. This compares favourably to UK assets, which experienced a fall in rate of return from 8.1% to 5.9% over the same period. This can mainly be attributed to OECD Ex countries’ rate of return generated on their UK based assets, which increased from 3.0% to 4.7% over the period, partly offsetting moderate falls in all other regions.

Figure 6: UK FDI assets and liabilities by economic region

UK, 2011 to 2014

Source: Office for National Statistics

Download this image Figure 6: UK FDI assets and liabilities by economic region

.png (8.8 kB) .xls (18.9 kB)

Figure 7: UK FDI rates of return by economic region

UK, 2011 to 2014

Source: Office for National Statistics

Download this image Figure 7: UK FDI rates of return by economic region

.png (13.5 kB) .xls (18.9 kB)Between 2011 and 2014, the overall effect of the fall in credits the UK receives and debits it pays resulted in deteriorations in its overall net FDI income with all economic regions: deteriorating by £30 billion with OECD Ex countries; £14 billion with G7 countries; £3 billion with emerging countries; and £6 billion with other countries.

OECD Ex

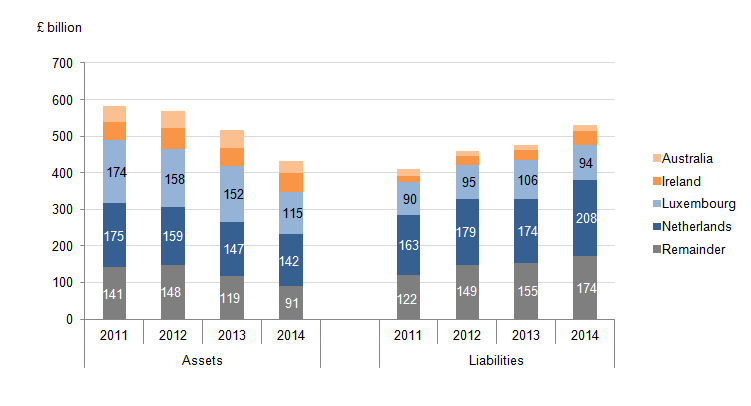

The OECD Ex country grouping – where the majority of the decline in UK net FDI income occurred – comprises of OECD member states excluding those belonging to the G7 or emerging markets categories. The main destinations of UK assets within this grouping during 2014 were in the Netherlands (33%), Luxembourg (27%), Ireland (12%), and Australia (8%). In contrast, the main source of liabilities into the UK from within this grouping was from the Netherlands (39%), Luxembourg (18%), Switzerland (10%), and Spain (10%). As Figure 8 highlights, the value of UK assets in the majority of countries within this grouping declined between 2011 and 2014; whereas the value of liabilities rose.

Figure 8: UK FDI Assets and liabilities with OECD ex countries

UK, 2011 to 2014

Source: Office for National Statistics

Download this image Figure 8: UK FDI Assets and liabilities with OECD ex countries

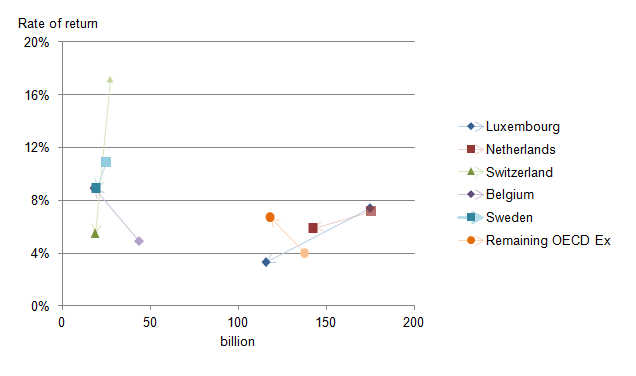

.png (16.3 kB) .xls (18.4 kB)In addition to the decline in the value of assets held within OECD Ex countries by the UK, the rates of return these assets generated also declined. Figure 9 shows the changes in the stock of investment and rates of return between 2011 and 2014 of the largest five countries in terms of declines in credits (Luxembourg, the Netherlands, Switzerland, Belgium and Sweden), alongside the remainder of countries within the grouping. The light data points indicate 2011 figures, and darker ones 2014. Shifts towards the vertical axis indicate disinvestment, whereas shifts towards the horizontal axis indicate deteriorations in the rate of return, and vice versa.

The two largest declines in credits from OECD Ex countries between 2011 and 2014 occurred within the Netherlands and Luxembourg, where credits fell 33% and 71% respectively. As Figure 9 indicates, these declines reflected both disinvestment and a lower rate of return. Approximately 44% of the decline in credits from the Netherlands is explained by disinvestment, with the remainder explained by lower rates of return (from 7.2% to 5.9%). A similar proportion of the decline in credits from Luxembourg was due to disinvestment, with the remainder attributable to a fall in the rate of return (7.4% to 3.3%).

Disinvestment and a declining rate of return was also the cause of the decline in credits in Switzerland, Belgium, Sweden, and the remaining OECD Ex countries, although this was partly offset by a rise in the rate of return in Belgium and the remaining OECD Ex countries.

Figure 9: Changes in Stock of FDI assets and rates of return between 2011 and 2014

UK

Source: Office for National Statistics

Download this image Figure 9: Changes in Stock of FDI assets and rates of return between 2011 and 2014

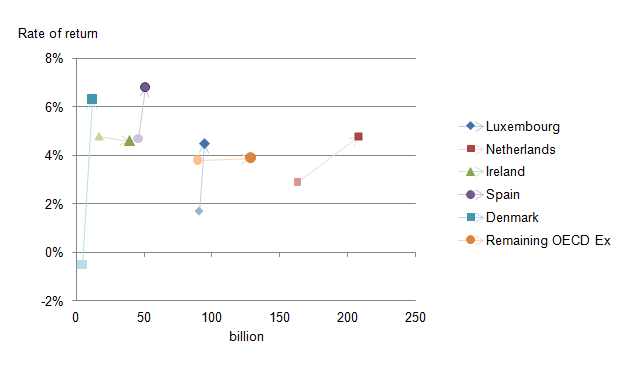

.png (17.6 kB) .xls (18.9 kB)Similarly to credits, the largest rises in debits from OECD Ex countries between 2011 and 2014 were to Luxembourg and the Netherlands, which rose by £2.6 billion and £5.3 billion respectively. However, almost all of the increase in Luxembourg was due to increased rates of return on UK based assets (from 1.7% to 4.5%), whereas just under three-quarters of the increase in debits from the Netherlands was due to increased rates of return (2.9% to 4.8%), with the remainder reflecting increased investment, as shown in Figure 10.

Other increases in debits occurred in Spain and Denmark, which reflected both increased UK investment and rates of returns. Debits to Ireland and the remaining countries in the OECD Ex grouping also rose, though these reflected increased investment, with slight decreases in the rate of return offsetting these rises.

Figure 10: Changes in stock of FDI liabilities and rates of rates of return between 2011 and 2014

UK

Source: Office for National Statistics

Download this image Figure 10: Changes in stock of FDI liabilities and rates of rates of return between 2011 and 2014

.png (16.8 kB) .xls (18.9 kB)Immediate and Ultimate Investment Destination

Given the value of assets and liabilities between the UK and the Netherlands and Luxembourg, any change in the rate of return or stock of investment will have a notable impact on UK net FDI earning; 41% of the overall decline in the UK’s net FDI earnings was attributable to these two countries.

Although the Netherlands and Luxembourg are important UK partners in terms of foreign direct investment, FDI statistics report the immediate investing country rather than ultimate investing country. The Netherlands and Luxembourg are widely regarded as financial centres – where investment is generally in transit and intended for an ultimate destination. However, determining the ultimate destination of investment is often complicated by factors, such as the complex structures of multinational companies and the use special purpose entities2.

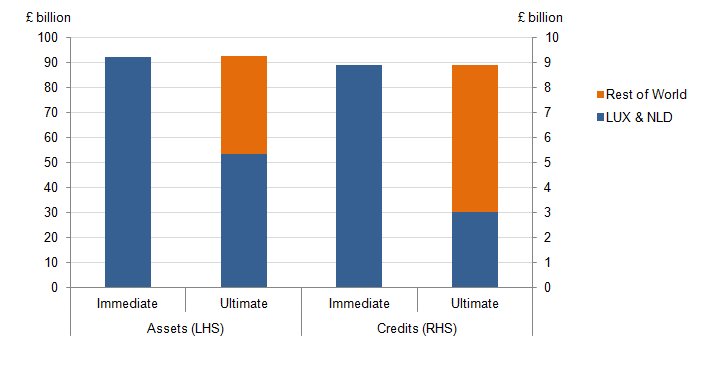

Since the implementation of Balance of Payments Manual 6, an additional question has been added to the FDI questionnaire, asking businesses engaging in FDI where their ultimate investment origin (on the inward survey) or ultimate investment destination (on the outward survey) is, in line with international standards and guidance. Figure 11 presents experimental statistics of the value of FDI assets and credits3 in the Netherlands and Luxembourg, and their ultimate destinations. Further analysis is required to undertake this for liabilities and debits. Using information on ultimate investment destination does not undermine the overall level of FDI being undertaken, but may result in a reallocation across countries.

Figure 11: FDI assets and credits by immediate and ultimate investment country for Luxembourg and Netherlands, 2014

UK

Source: Office for National Statistics

Notes:

- The detail previously provided for ultimate destination of investment at initial publication has been reduced due to quality concerns. These statistics were labelled as experimental and further work is required before detailed country and industry data are provided. Apologies for any inconvenience caused.

Download this image Figure 11: FDI assets and credits by immediate and ultimate investment country for Luxembourg and Netherlands, 2014

.png (12.7 kB) .xls (37.4 kB)Using the ultimate investing destination, the value of UK assets based in the Netherlands and Luxembourg falls by 42%, from £92 billion to £53 billion in 2014, as shown in Figure 11. The ultimate destination of the £39 billion of reallocated assets highlights that a proportion of the investment is in transit and destined for a range of countries across the global economy.

A similar pattern is observed for UK credits, where using the ultimate destination reduces the value of UK credits received from the Netherlands and Luxembourg by 66%, from £8.9 billion to £3.0 billion in 2014, as shown in Figure 11.

G7

As highlighted earlier in Figure 5, the main driver of the deterioration in net FDI earnings from G7 and emerging countries between 2011 and 2014 was a decrease in credits, with debits remaining relatively stable over the period. Within G7, this change reflected declines in the United States (£4.5 billion), France (£3.2 billion) and Germany (£1.5 billion), as shown in Figure 12. The deterioration in the United States was largely due to a decline in the rate of return (from 8% to 5%), which was partly offset by a £68 billion increase in the stock of assets. The deteriorations in credits from France and Germany reflected both declines in rates of return and disinvestment. The decline in UK credits from the G7 as a whole was partly offset by increases from Italy, Canada and Japan.

Figure 12: Change in UK FDI credits from G7 countries between 2011 and 2014

UK

Source: Office for National Statistics

Download this chart Figure 12: Change in UK FDI credits from G7 countries between 2011 and 2014

Image .csv .xlsEmerging Markets

The UK experienced a decline in FDI credits from over half of the countries within the emerging markets category, with the top 10 largest declines shown in Figure 13.

Figure 13: Top 10 country contributors to decrease in UK credits from emerging markets between 2011 and 2014

UK

Source: Office for National Statistics

Download this chart Figure 13: Top 10 country contributors to decrease in UK credits from emerging markets between 2011 and 2014

Image .csv .xlsUK FDI and GDP Differentials

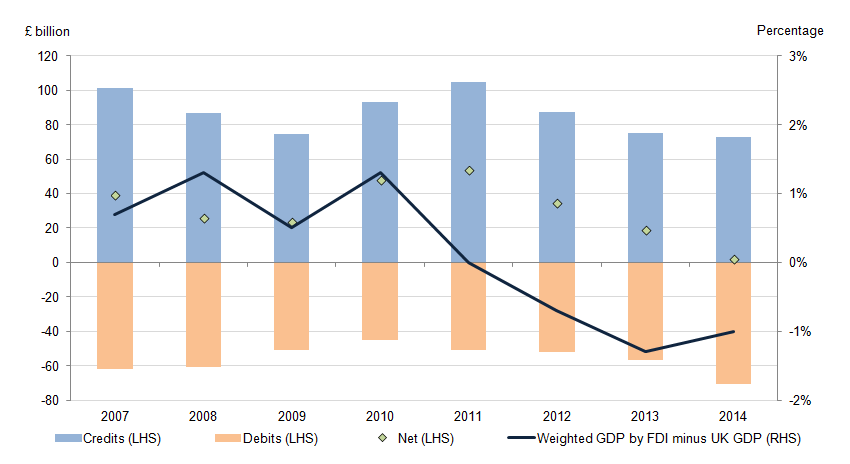

As discussed, the rate of return on UK liabilities has been more resilient than UK assets. This may partly be attributed to the performance of the UK economy relative to the economies with foreign direct investment links to the UK. Figure 14 shows a weighted average Gross Domestic Product (GDP) growth of countries the UK currently invests in minus UK GDP growth, to give an indication of relative economic performance. Periods where the figure is positive indicate that UK GDP is underperforming relative to its FDI partners, and vice versa. Between 2007 and 2010, the economies in which the UK holds assets outperformed the UK. However, this changed in 2011 due to a combination of a strengthening UK economy and slowing global economy; the latter driven predominantly by the European Union, where the UK holds a large proportion of its assets. This change in relative performance may have impacted the relative rate of return, and in the long term the stock of assets and liabilities held.

Figure 14: GDP weighted by UK asset destinations minus UK GDP, and FDI credits and debits

UK, 2007 to 2014

Source: Office for National Statistics, International Monetary Fund, Eurostat

Download this image Figure 14: GDP weighted by UK asset destinations minus UK GDP, and FDI credits and debits

.png (24.5 kB) .xls (18.4 kB)Notes for FDI by Economic Region

Standard and Poor’s Emerging Market Index’s list of 38 countries has been used to define UK FDI partners as emerging

Definition of Special Purpose Entities can be found via this link

FDI values presented are of those sampled only, which make up 36% of the total value of assets and 73% of credits in both countries

6. Rates of Return Distributions

The performance of the UK economy relative to its FDI destinations is a key determinant of its net FDI income. As set out in the FDI and the Current Account section, the UK’s net FDI credits depend on both the stocks of assets that the UK holds abroad and the stock of assets non-resident entities hold in the UK, as well as the relative rates of return on their respective portfolios. However, while the stock of UK FDI assets has fallen relative to its liabilities, a relative fall in the UK’s rate of return appears to have played an important role in the development of a deficit on primary income (Figure 15). During much of 2010, 2011 and 2012, the UK received a higher rate of return on its direct investment assets than overseas investors gained from assets in the UK. Yet in the period since 2012 – coinciding with the fall in the balance on primary income – the rates of return on direct investment have converged.

Figure 15: Rates of return on UK FDI assets and liabilities, %

UK, 2006 to 2014

Source: Office for National Statistics

Download this chart Figure 15: Rates of return on UK FDI assets and liabilities, %

Image .csv .xlsWhile changes in the aggregate rate of return provide a measure of the average performance of UK assets and liabilities, they can be driven by a relatively small number of projects with very high or low profits. For instance, the decline in the rate of return on UK assets might be driven by a general reduction in returns on UK FDI across all industries and regions, or it might be driven by a sharp slowing of some of the UK’s largest FDI assets. As the policy implications of these two possibilities are sharply different, understanding the drivers of the change in the rates of return is important.

Figure 16 presents a more detailed picture by showing the distribution of rates of return across the UK’s stock of assets in each time period. The stocks of UK assets overseas are ranked by rate of return at selected percentile points of the distribution. For instance, between 2012 and 2014, the lowest performing £128 billion of the UK’s £1.28 trillion stock of overseas assets had a rate of return lower than -0.9%, while the highest performing £140 billion of UK overseas assets had a rate of return in excess of 17.4%. The points in between provide some sense of how the rates of return vary for the remainder of the UK’s FDI stock: shifts rightward in this line indicate that more of the UK’s stock of assets is generating a lower rate of return, shifts to the left indicate the converse.

Figure 16: Distribution of rates of return for assets, 2006 to 2014 comparison

UK

Source: Office for National Statistics

Notes:

- Percentiles are calculated from outward assets and inward liabilities respectively

- Unit for x axis: Percentile

Download this chart Figure 16: Distribution of rates of return for assets, 2006 to 2014 comparison

Image .csv .xlsThis analysis suggests that the recent fall in the average rate of return for the UK’s assets reflects a combination of downwards pressure on the performance of some of the UK’s mid-performing assets and a worsening of the performance of some of our least productive assets. The rate of return on the lowest-performing 70% of UK FDI assets overseas fell between the 2009-11 and 2012-14 period, shown by the rightwards shift in the curve over this period, indicating a lower rate of return for these assets. By contrast, the rates of return on the highest performing 30% of UK assets were broadly unchanged over this period, and were slightly stronger than during the economic downturn in 2008. However, compared to the 2006-07 period, the rates of return remain depressed across the asset stock: the median rate of return in 2012-14 remains 3.3 percentage points below this pre-downturn average.

A similar analysis can be produced for the UK’s liabilities (Figure 17), which suggests that the distribution of rates of return on overseas holdings in the UK has been relatively stable over this time period. As above, rightwards shifts in this curve through time indicate a fall in the rate of return associated with a larger fraction of overseas holdings, while leftwards shifts indicate the converse. In contrast to the UK’s asset position, rates of return earned by overseas agents in the UK are broadly unchanged for the lowest-performing 70% of UK liabilities over this period. However, there is more movement at the top of the distribution. The rate of return exceeded by the UK’s 10% highest performing liabilities fell following the economic downturn – from 23.0% in 2008, to 17.4% in 2009-11 and to 13.3% in 2012-14.

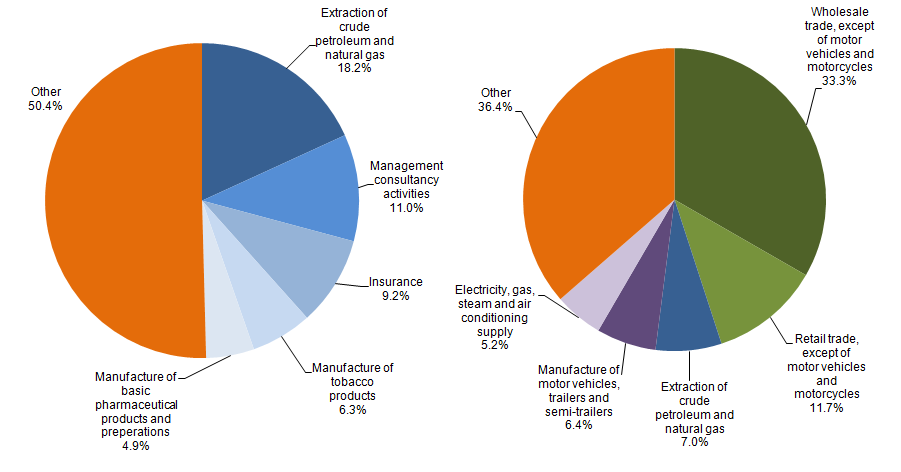

Figure 17: Distribution of rates of return for liabilities, 2006 to 2014 comparison

UK

Source: Office for National Statistics

Notes:

- Percentiles are calculated from outward assets and inward liabilities respectively

- Unit for x axis: Percentile

Download this chart Figure 17: Distribution of rates of return for liabilities, 2006 to 2014 comparison

Image .csv .xlsTo understand the nature of these high-performing assets and liabilities, Figure 18 shows their industrial composition, and highlights some notable differences between the strongest performing assets that UK agents hold overseas as compared with the highest performing overseas assets held in the UK. The left hand panel of Figure 18 shows that more than 18% of the highest performing UK assets are in the extraction of crude petroleum and natural gas industry and a further 11.2% are in the manufacture of pharmaceuticals and tobacco products. Financial services related to insurance account for 9.2% of these assets, while management consultancy activities account for a further 11.0%. By contrast, UK liabilities are more heavily concentrated in the wholesale and retail sectors – which account for 45% of these holdings in total. Assets in the extraction of crude petroleum and natural gas (7.0%) and the manufacture of motor vehicles industries (6.4%) also account for a relatively large share of these liabilities. As a consequence, the changing fortunes of these industries at a global level will have differential impacts on the UK’s FDI balance.

Figure 18: Industrial composition of top 10% of investment for assets (LHS) and liabilities (RHS), 2014

UK

Source: Office for National Statistics

Notes:

- Negative assets and liabilities were excluded from industry rates of return calculations.

Download this image Figure 18: Industrial composition of top 10% of investment for assets (LHS) and liabilities (RHS), 2014

.png (39.4 kB) .xls (18.4 kB)7. FDI Earnings by Industry

Figure 19 shows the changes in net FDI earnings between 2011 and 2014 by industry, and the amount of change attributable to credits and debits. The three industries experiencing the largest declines in net FDI earnings were production (from £35 billion to £10 billion); transport, storage & communication (£6 billion to -£7 billion); and distribution, hotels & restaurants (-£0.2 billion to -£12 billion).

Figure 19: Changes in Net UK FDI Earnings by Industry between 2011 and 2014

UK

Source: Office for National Statistics, Financial Times

Download this chart Figure 19: Changes in Net UK FDI Earnings by Industry between 2011 and 2014

Image .csv .xlsOil and Gas Industries

The decline in net FDI earnings from the production industries between 2011 and 2014 reflected a £20 billion decrease in credits and a £5 billion increase in debits. The largest contributors to the decrease in earnings from within this industry group were the mining & quarrying industries1, where credits and debits fell by £11 billion and £3 billion respectively over the period.

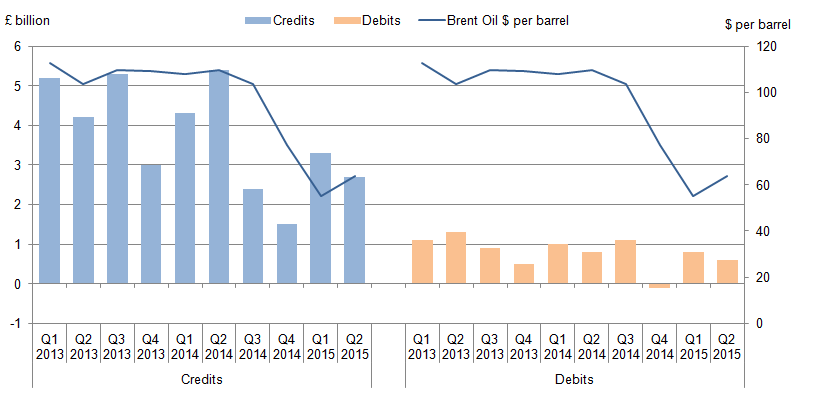

The decline in both credits and debits from the mining & quarrying industries may be due to the recent decline in oil prices, with the price of a barrel of oil falling from an annual average of approximately $110 between 2011-2013, to $103 in Q3 2014 and $77 in Q4 2014. The price of a barrel fell further in Q1 2015 to $55 before a slight recovery in Q2 2015 at $64. However, the impact on credits and debits may have been asymmetrical due to the stock of UK assets and liabilities.

In Q2 2014, shortly before the decline in oil prices, the UK held £231 billion of assets in the oil & gas industries across the global economy, while UK liabilities were £151 billion during the same quarter. Given the relative size of the UK’s assets compared to its liabilities within these industries, it is likely that a fall in the price of oil during the second half of 2014 would have had a greater impact on UK credits than debits, therefore deteriorating its net earnings.

The impact of the fall in oil prices on UK credits and debits is shown in Figure 20; credits fell from £5.4 billion in Q2 2014, to £1.5 billion in Q4 2014, before recovering partly to £2.7 billion in Q2 2015. The impact on UK debits is similar; however, due to the lower stock of investment into the UK, the impact on debits is less evident. It can be observed, but to a lesser extent: debits rose from £0.8 billion in Q2 2014 to £1.1 billion in Q3 2014, before falling to -£0.1 billion in Q4 2014. In 2015 debits increased to £0.6 billion by Q2.

Figure 20: UK credits and debits in the oil and gas extraction industries

UK, Quarter 1 (Jan to Mar) 2013 to Quarter 2 (Apr to June) 2015

Source: Office for National Statistics, Financial Times

Notes:

- Q1 refers to Quarter 1 (January to March), Q2 refers to Quarter 2 (April to June), Q3 refers to Quarter 3 (July to September) and Q4 refers to Quarter 4 (October to December).

Download this image Figure 20: UK credits and debits in the oil and gas extraction industries

.png (14.9 kB) .xls (18.9 kB)Information and Communication Industries

The larger of the two industry sections that make up transport, storage & communication are the information and communication (IC) industries3, accounting for 15% of UK FDI assets and 11% of liabilities in 2014. The UK experienced a notable deterioration in its net FDI earnings from the IC industries between 2011 and 2014, falling from a surplus of £6.2 billion to a deficit of £4.2 billion over the period. This deterioration occurred broadly across all industries within the section; however, the largest contributor to the decline was telecommunications.

The decline in net earnings is mostly attributable to falls in credits within most IC industries (excluding publishing activities), which fell from almost £9.7 billion in 2011 to £1.1 billion in 2014, as illustrated by the blue bars in Figure 21. The largest decline occurred between 2011 and 2012, largely driven by telecommunications. Debits from the IC industries also rose, from £3.6 billion to £5.3 billion, as seen by the orange bars in Figure 21.

Figure 21: FDI earnings in information and communication industries

UK, 2011 to 2014

Source: Office for National Statistics

Download this chart Figure 21: FDI earnings in information and communication industries

Image .csv .xlsThe value of the UK’s FDI IC industry assets had indeed fallen from £177 billion in 2011 to £158 billion in 2013, before increasing to £180 billion in 2014. This increase in the value of assets between 2011 and 2014 suggests it is the rate of return that has caused the change in credits from the IC industries, rather than an overall disinvestment. This may reflect reallocation of UK assets into investments with lower rates of return. Figure 22 illustrates this point, where the stock of assets appear relatively stable while the rate of return deteriorates from 5.5% to 0.6%. In terms of liabilities, the value of the stock of investment overseas investors held in the UK within this industry rose from £133 billion to £172 billion between 2011 and 2013, before declining to £150 billion in 2014. This is shown in Figure 22. The combined changes in both assets and liabilities resulted in the UK’s net investment position within IC falling from £44 billion to -£14 billion between 2011 and 2013, before rising to £30 billion in 2014. The fall and part recovery in the net investment position was driven by telecommunications.

Figure 22: FDI positions and rates of return in information and communication industries

UK, 2011 to 2014

Source: Office for National Statistics

Download this image Figure 22: FDI positions and rates of return in information and communication industries

.png (21.7 kB) .xls (18.9 kB)Wholesale and Retail Industries

The larger of the two industry sections that make up distribution, hotels & restaurants are the wholesale and retail industries4, which accounted for 6% of total UK FDI assets in 2014 and 11% of total liabilities. The UK’s net FDI earnings within the wholesale & retail industries experienced a notable deterioration from -£1.6 billion in 2011 to -£12.6 billion in 2014. This deterioration occurred broadly across all industries within the section, although the largest negative contribution came from wholesale (excluding motor vehicles), as shown in Figure 23.

The majority of the decline in net earnings was due to large increase in debits, which rose from £5.5 billion in 2013 to £14.7 billion in 2014. The majority of this increase occurred in the wholesale (excluding motor vehicles) industries. A deterioration in credits also occurred over the period, falling from £3.9 billion to £2.0 billion.

Figure 23: FDI earnings in wholesale industries

UK, 2011 to 2014

Source: Office for National Statistics

Download this chart Figure 23: FDI earnings in wholesale industries

Image .csv .xlsThe rise in debits is partly attributable to the increased investment into the UK from overseas into these industries, which increased in value from £103 billion to £153 billion between 2011 and 2014, as shown by the orange bars in Figure 24. The majority of this increase occurred in the wholesale (excluding motor) industries. In addition to the increase in investment was an increase in the rate of return generated by overseas investors, which rose from 4.9% to 9.6% over the same period.

The decline in credits within the industry between 2011 and 2014 reflected both a decline in assets (from £82 billion to £74 billion) and decline in the rate of return on UK assets (4.7% to 2.8%), as highlighted in Figure 24.

Figure 24: FDI positions and rates of return in wholesale industries

UK, 2011 to 2014

Source: Office for National Statistics

Download this image Figure 24: FDI positions and rates of return in wholesale industries

.png (18.5 kB) .xls (18.4 kB)Notes for FDI Earnings by Industry

Referred to as Section B within SIC 2007

Referred to as Division 60 and Division 90 within SIC 2007

Referred to as Section J within SIC 2007. These industries include industries involved in the production and distribution of information and cultural products, the provision of the means to transmit or distribute these products, as well as data or communications, information technology activities and the processing of data and other information service activities

Referred to as ‘Wholesale and retail trade; repair of motor vehicles, motorcycles and personal and household goods’ (Section G) within SIC 2007. These industries include industries involved in the wholesale, retail & repair of motor vehicles; wholesale trade of products; and retail trade

8. FDI by Size of Investment

The change in UK credits and debits can also be analysed by firm size1, defined by the net book value of the FDI. Both credits and debits have been mainly impacted by the largest 5% of firms; very large firms contributed £22 billion to the overall decline in credits between 2011 and 2014, 69% of the total. With the exception of medium sized firms, who contributed a gain of £1.4 billion, all other firm sizes contributed negatively to the overall decline, as shown in Figure 25.

In contrast, the increase in UK debits was more broad based, with very large, large and medium firms contributing to the increase, although the latter’s contribution was very small.

Figure 25: Change in UK credits and debits by firm size

UK

Source: Office for National Statistics

Download this chart Figure 25: Change in UK credits and debits by firm size

Image .csv .xlsThe importance and impact of large firms is highlighted when analysing the UK current account. The contribution of FDI has been divided into two categories: very large companies and the remaining companies (large, medium, and small) in a single category. Very large firms’ credits decreased from £91 billion in 2011 to £67 billion in 2014, shown in Figure 26, and are the main drivers of the decline. The remaining firms also contribute, but to a lesser extent.

The changes in UK debits are also driven by the top 5% of firms – which increased from £37 billion to £53 billion between 2011 and 2014. The remaining firms also contributed to a lesser degree, accounting for 26% of the overall increase in FDI debits over the period.

Figure 26: Changes in UK current account by firm size between 2011 and 2014

UK

Source: Office for National Statistics

Notes:

- Very large firms’ credits decreased from £91 billion in 2011 to £67 billion in 2014.

Download this chart Figure 26: Changes in UK current account by firm size between 2011 and 2014

Image .csv .xlsNotes for FDI by Size of Investment

- Very large firms are defined as the top 5% of firms by net book value, large firms as between 95% and 75%, medium firms as between 75% and 25%, and small firms below 25%

9. New and Existing FDI

The recent movements in both credits and debits have been impacted by changes in assets and liabilities; this has been particularly evident in the latter. Figure 27 breaks down these changes into the impact of the stock of existing and new FDI1. Existing FDI is primarily impacted by re-valuations and increased investment into existing assets, whereas new FDI occurs due to changes in global company structures, which can result in new FDI relationships being established, or more commonly, new companies have been established that have an FDI relationship with the UK.

UK assets have fallen consistently since 2012. This can be mainly attributed to a reduction in the value of existing FDI assets held by the UK, which has been partly offset by new FDI being undertaken; £75 billion in 2013 and £38 billion in 2014.

Figure 27: UK assets and liabilities by new and existing

UK, 2012 to 2014

Source: Office for National Statistics

Notes:

- 2012 is Total Assets/Liabilities.

Download this image Figure 27: UK assets and liabilities by new and existing

.png (12.4 kB) .xls (17.9 kB)The overall decline in UK liabilities in 2013 was due to a reduction of £131 billion in existing liabilities; this was partly offset by £101 billion of new FDI. In 2014, however, there was a large increase in the value of existing liabilities by £79 billion in 20142. Coupled with £84 billion of new FDI, this resulted in the value of UK liabilities rising by £162 billion.

Notes for New and Existing FDI

New FDI is defined as investments by firms into a country that were not observed in the previous year, as shown by the orange bars in Figure 26. Existing FDI are investments observed both in the reporting year and the previous, represented by the blue bars

Existing stock in 2014 minus total stock in 2013

10. Exchange Rate Movements

Changes in the value of Sterling also appear to have influenced both the UK’s net FDI earnings and positions over the last decade, although movements in exchange rates cannot explain the weakness in the UK’s FDI income balance. All else equal1, currency depreciations – where the value of a domestic currency falls relative to a basket of foreign currencies – increase the domestic currency value of earnings abroad to the extent that these are denominated in foreign currencies2. Each (unchanged) foreign currency unit of earnings is worth more domestic currency units, leading to a rise in the value of credits. Conversely, a currency appreciation – in which the domestic currency rises in value against a basket of foreign currencies – will reduce the domestic currency value of overseas earnings, as each (unchanged) unit of foreign currency earnings is worth fewer domestic currency units. FDI debits – provided they are denominated in the domestic currency – will be unaffected directly by the exchange rate. Consequently, movements in the exchange rate can affect net FDI earnings – even if there is no change to the underlying performance of UK assets and liabilities.

Equally, changes in the exchange rate can affect the reported value of an economy’s assets and liabilities. All else equal, a depreciation (appreciation) of the domestic currency increases (reduces) the domestic currency value of overseas assets. If the domestic currency value of the UK’s liabilities is unaffected by the exchange rate, changes in the value of the domestic currency can have an impact on the net asset position of an economy3.

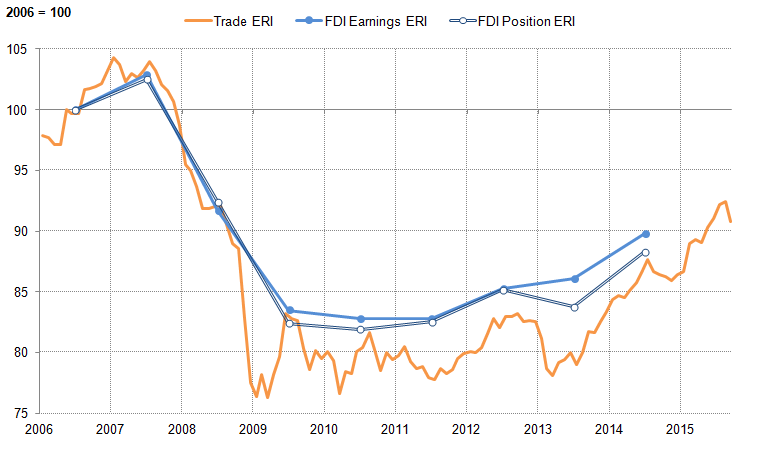

These effects are particularly relevant to the UK because the value of sterling has changed considerably over recent years. On a trade-weighted basis, the Sterling Effective Exchange Rate index (ERI) depreciated by 22.3% between 2007 and 2009, in one of the largest sterling exchange rate movements of the past three decades. On the same basis, the ERI increased by 6.8% during 2014 and has continued to strengthen, rising by a further 5% in the first nine months of 2015. Weighting bilateral exchange rates by the extent of FDI – rather than trade – produces broadly similar trends (Figure 28). Weighting bilateral exchange rates using FDI credits or FDI positions produces a slightly smaller peak to trough fall in sterling, 18.9% when weighted by credits, and a smaller appreciation in 2014. This suggests that while the exchange rate movement relevant to FDI may have been less extreme than that affecting trade flows, there was a pronounced currency effect that may have influenced the UK’s FDI position.

Figure 28: Sterling exchange rate index (ERI), weighted by trade (exports), FDI earnings (credits), and FDI positions (assets)

Source: Office for National Statistics

Notes:

- FDI-weighted data are annual, trade-weighted data are monthly.

- FDI weighted exchange rates are calculated by weighting bilateral exchange rates by the shares of FDI credits (FDI Earnings ERI) and positions (FDI Position ERI) accounted for by the match.

Download this image Figure 28: Sterling exchange rate index (ERI), weighted by trade (exports), FDI earnings (credits), and FDI positions (assets)

.png (39.7 kB) .xls (20.5 kB)As these ERIs present the weighted average value of a currency against a basket of other currencies, they inevitably mask a range of more detailed currency movements which are important for understanding developments in the FDI position. A stronger ERI, for instance, might reflect a broad-based appreciation of sterling against a basket of currencies, or a marked strengthening against a few, heavily-weighted currencies partially offset by a depreciation against others. While the appreciation may weaken the UK’s FDI position in both cases, in the former case this weakening is effected by reducing income from a broad range of countries; in the latter it arises through changes to a specific set of FDI relations. From this, it is clear that understanding patterns of bilateral exchange rates is important for understanding changes in the FDI position.

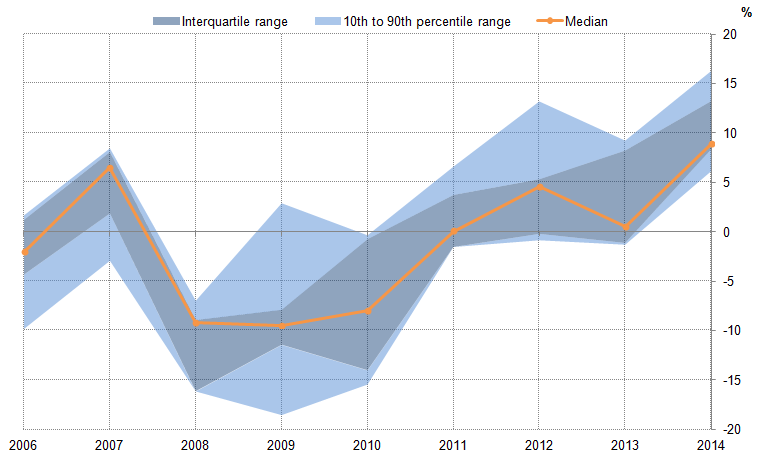

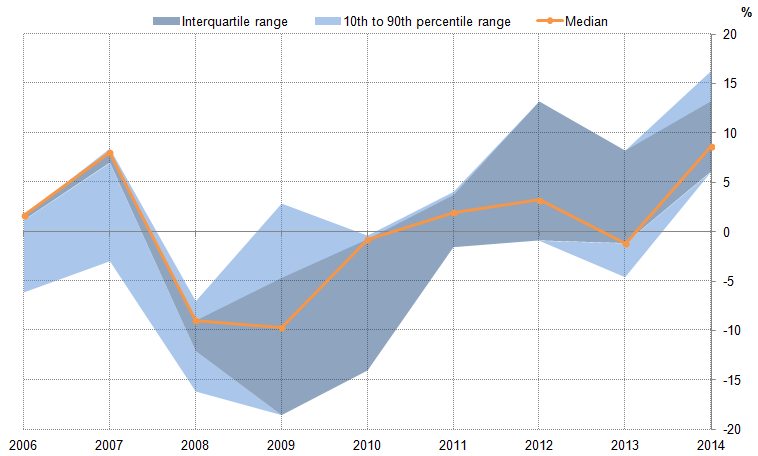

Figure 29 provides some sense of how movements in bilateral exchange rates have affected UK FDI credits in recent years by showing the distribution of currency changes associated with these earnings flows. The currency effect – expressed as the movement of sterling relative to the partner country – associated with each credit is calculated in each year, and the credits are ordered from the lowest currency effect to the highest currency effect. The median (in orange) shows the currency appreciation or depreciation which is at the centre of this distribution: the level of currency effect which half the value of the UK’s FDI credits lie above and below. The inter-quartile range (dark blue) and the 10th to 90th percentiles (light blue) show the range of currency effects associated with the middle 50% and 80% of the value of UK FDI credits respectively. This approach strips out the largest currency effects, and provides a sense of how broadly-based the impact of an exchange rate change is in terms of FDI credits.

For instance, in 2007, more than 75% of the value of UK credits is associated with an appreciating currency effect in excess of 1.8%, reflecting the appreciation of sterling against a range of currencies in this year. However, 10% of UK credits were associated with a fall in the value of sterling in the same year – suggesting that the strength of the ERI in that year reflects a mix of movements against a range of currencies. It follows that in 2007, some earnings flows were likely stronger because of currency movements (those associated with depreciation effects), while others were weaker (those associated with appreciation effects).

Figure 29: Distribution of currency movement, weighted by FDI credits

Source: Office for National Statistics

Notes:

- Summary statistics on the distribution of currency effects associated with UK credits.

Download this image Figure 29: Distribution of currency movement, weighted by FDI credits

.png (29.8 kB) .xls (18.9 kB)Figure 29 also suggests that the range of currency effects has varied in recent years in a manner which is hidden by the ERI. In 2008, the range of effects was relatively narrow: the vast majority of the value of UK earnings was supported by a depreciation effect in this year. In 2009, by contrast, the range of outcomes was much broader. Despite the ongoing depreciation of sterling and a depreciation effect in excess of 18.6% for 10% of UK FDI credits, more than 10% of UK credits were associated with an appreciation effect. In 2011, the range of currency effects narrowed once again, while the recent appreciation of sterling in 2014 appears to have been fairly wide-spread: 90% of UK credits by value have experienced an appreciation of over 6.1% and half have experienced an appreciation effect of over 9.0%.

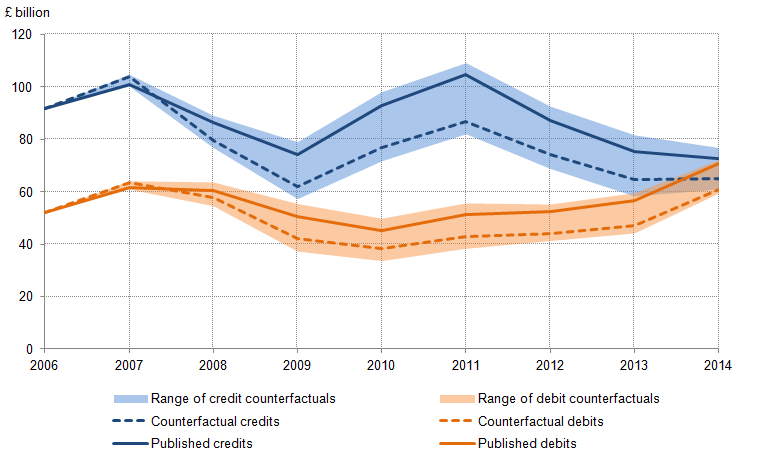

To analyse the aggregate impact of these currency effects on FDI credits and debits, ONS has constructed a set of counterfactual credit and debit series which exclude the direct impact of exchange rate changes. These counterfactual series – which are sensitive to assumptions about the currency in which earnings are made, making a precise estimate of the impact of the exchange rate challenging – provide a yardstick against which the published series can be compared to yield a broad estimate of the impact of the exchange rate on the FDI income position. In Figure 30, the solid lines reflect the published series, while the dotted lines show the levels of UK credits and debits (a) holding the sterling exchange rate with all currencies in 2006 constant and (b) assuming that these are all earned in the relevant foreign currency. The range of possible outcomes – indicated by the shaded area – tests a range of alternative assumptions about the currency in which credits and debits are earned.

Figure 30: FDI credits and debits – published totals and counterfactual estimates

UK, 2006 to 2014

Source: Office for National Statistics, Bank of England and Oanda

Notes:

- Dashed lines indicate counterfactual credit and debit series (a) assuming that all credit/debits are held in foreign currencies and (b) holding constant bilateral Sterling exchange rates from 2006. Range of counterfactuals provides an indication of the impact of alternative assumptions about the currency in which credits/debits are earned.

Download this image Figure 30: FDI credits and debits – published totals and counterfactual estimates

.png (41.2 kB) .xls (20.5 kB)Figure 30 suggests that changes in the exchange rate flattered the UK’s FDI credits over this period, as the published series (which includes the impact of changes in the value of sterling) is higher than the counterfactual (which excludes the exchange rate changes) between 2007 and 2014. The same is true for the UK’s FDI debits, albeit to a lesser extent, suggesting that the exchange rate effect may have been more pronounced for credits than for debits.

However, both results are dependent on assumptions about the currency in which these credits and debits are denominated. This is shown in the range of outcomes – which capture the sensitivity of this result to variation in these assumptions – which indicate that some combinations of assumptions flatter the UK’s FDI income position more than others. Between 2007 and 2009, most of the counterfactual results suggest that absent changes in the exchange rate, both credits and liabilities would have been lower than their published amounts. However, some combinations of assumptions indicate that constant exchange rates would have increased both credits and debits. Between 2010 and 2014, the narrowing gap between credits and debits in published figures is mirrored by a similar trend among the range of counterfactuals. This suggests that the recent appreciation in sterling has had a relatively limited impact on the FDI income position.

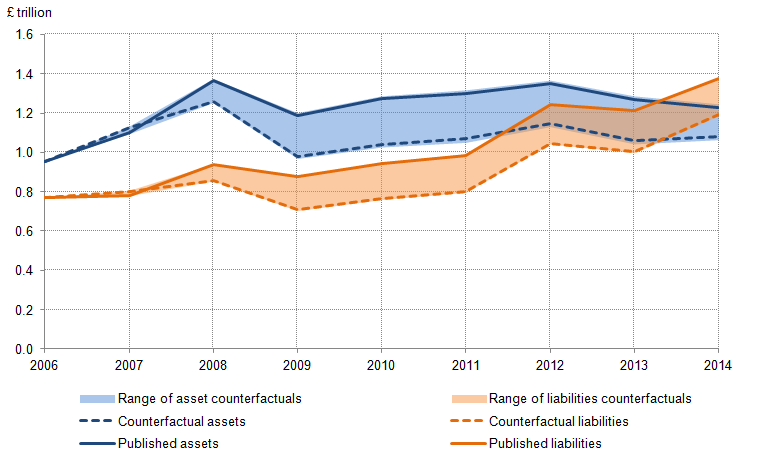

The same analysis can be applied to the UK’s FDI asset and liability positions. Figure 30 shows the distribution of currency effects for the UK’s FDI assets on the same basis as Figure 30 above. As before, it indicates that the range of currency effects in 2008 was relatively narrow, highlighting the broad-based nature of the depreciation of sterling this year. Of the UK’s stock of assets overseas, 10% were associated with a currency depreciation of more than 16.2%, while only 10% were associated with a depreciation of 7.0% or less. Reflecting the currency effects for the UK’s FDI earnings, the range of effects varies through time.

However, there are some notable differences between Figure 30 and Figure 32. In 2006 and 2007, the inter-quartile range is relatively small at below or around 1 percentage point, which grew to an average of 13.9 percentage points from 2009 onwards. While this increase in the inter-quartile range is unique to positions-weighted data, trends in the spread between the 10th and 90th percentile are similar between earnings- and positions-weightings. The extremes of the two distributions have therefore followed similar trends, while trends at the centre of the two distributions have differed slightly. This is most evident in 2010, when the median earnings-weighted depreciation was 8.0% while the median positions-weighted depreciation was 0.8%. Intuitively, these results suggest that the majority of the UK’s overseas assets and earnings are denominated in similar currencies, while a minority of earnings and asset positions denominated in different currencies drive the width of the distribution through time.

Figure 31: Distribution of currency movement, weighted by FDI assets

UK, 2006 to 2014

Source: Office for National Statistics, Bank of England and Oanda

Notes:

- Summary statistics on the distribution of currency effects associated with UK credits.

Download this image Figure 31: Distribution of currency movement, weighted by FDI assets

.png (37.5 kB) .xls (18.4 kB)Figure 32 presents a similar analysis to Figure 31 above, for the UK’s asset and liability positions. As before, the majority of the counterfactual scenarios presented here indicate that the UK’s net FDI position was flattered by the depreciation of sterling between 2007 and 2009. Assuming that all assets and liabilities are held in foreign currencies, holding exchange rates constant has a larger downward effect on assets than liabilities. This effect has moderated slightly in recent years, as the exchange rate effect associated with the UK’s assets has narrowed relative to that associated with the UK’s liabilities.

Figure 32: FDI asset and liability positions – published totals and counterfactual estimates

UK, 2006 to 2014

Source: Office for National Statistics, Bank of England and Oanda

Notes:

- Dashed lines indicate counterfactual asset and liability series (a) assuming that all assets/liabilities are held in foreign currencies and (b) holding constant bilateral Sterling exchange rates from 2006. Range of counterfactuals provides an indication of the impact of alternative assumptions about the currency in which assets/liabilities are held.

Download this image Figure 32: FDI asset and liability positions – published totals and counterfactual estimates

.png (31.6 kB) .xls (20.5 kB)However, while this analysis indicates that changes in the exchange rate had a bearing on the UK’s FDI position, it cannot account for recent trends in these two series. For the first since records began, the UK’s net FDI position became negative in 2014, driven by a sharp rise in FDI liabilities in 2014. Figure 32 suggests that while currency movements may have delayed this development, the majority of counterfactuals in the blue and orange shaded areas in Figure 32 imply the UK’s net FDI position would likely still have been negative by 2014, absent any direct exchange rate effects.

Notes for Exchange Rate Movements

Note that this is a relatively strong assumption. Changes in the value of a currency partly reflect changes in the demand for assets denominated in that currency, as well as variation in the level of remittances from overseas assets. As a consequence, movements in the exchange rate cannot be seen as completely independent of the performance of a country’s assets, but instead they are likely to be jointly determined. As it empirically challenging to separate the impact of these effects on a currency, we assume the two are independent

Note that earnings and assets may be earned or held in a currency other than the official domestic currency of an economy, which complicates this analysis considerably. This is examined in more detail below; the example is intended to be illustrative

As with FDI credits and debits, this depends on the currency in which the assets are held. If UK assets are held in a currency other than sterling, then the impact of changes in the exchange rate may be more complex