1. Abstract

This article describes progress made to estimate the value of employee share options plans (ESOP) to the UK economy.

This work is part of the UK’s enhanced financial accounts (flow of funds) initiative, which is a partnership between the Office for National Statistics (ONS) and the Bank of England (the Bank).

Included within this article is a description of ESOP, details of a potential data source and an outline of the proposed method for using this data to measure the value of ESOP to the UK economy under the European System of Accounts 2010 (ESA 2010) framework.

The author would like to acknowledge the following contributors to this article: Leonidas Akritidis, Richard Campbell, Eric Crane and Phillip Davies.

Nôl i'r tabl cynnwys2. Introduction

The Office for National Statistics (ONS) has ambitious plans to transform our economic statistics over the coming years, informed by our Economic Statistics and Analysis Strategy with the aim of increasing the robustness and quality of UK economic statistics. Working in partnership with the Bank of England, an important element of our transformation work is the development of enhanced financial accounts – in particular, more detailed “flow of funds” statistics – to meet evolving user needs.

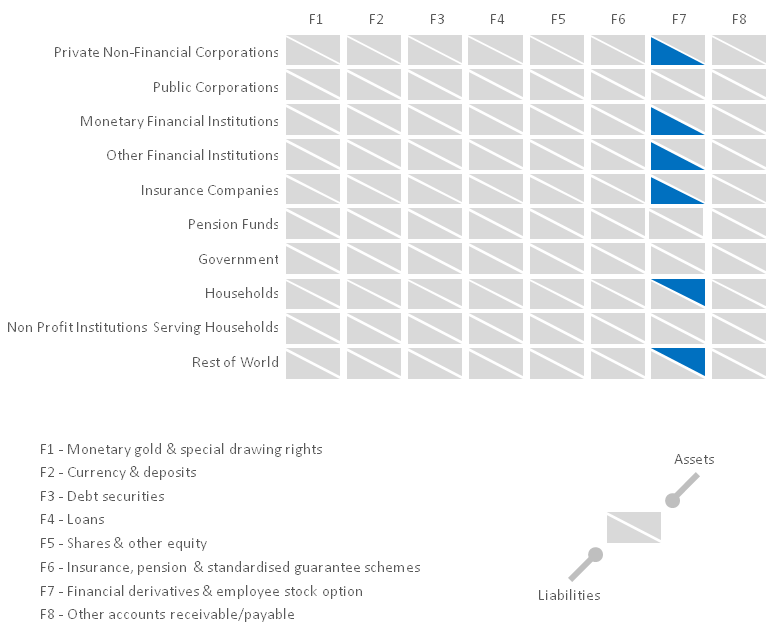

Flow of funds statistics will enable an increased understanding of how money moves in, around and out of the UK economy. One way of summarising this information is to use a matrix that shows the different parts of the economy (known as sectors) and the different means by which money can be moved (known as transactions). The matrix shown in Figure 1 highlights, by sector and transaction, the areas of the economy the proposed improvements to the estimates of employee stock options will impact.

Figure 1: Employee share options plans - UK flow of funds matrix impact visualisation

Source: Office for National Statistics

Download this image Figure 1: Employee share options plans - UK flow of funds matrix impact visualisation

.png (41.6 kB)Employee share options plans (ESOP) are a subset of transaction type F7 (financial derivatives and employee stock options), used by companies to remunerate employees in the households sector.

Our expectation is that most companies who use ESOP will be in the private non-financial corporations sector, though other companies in other sectors may participate too. Similarly, it is possible that overseas employees in the rest of the world sector may be remunerated through ESOP.

Nôl i'r tabl cynnwys3. Background

Employee share options plans (ESOP) are part of employees' remuneration for work undertaken for the company and are primarily used to keep participants focused on company performance and share price appreciation. By giving participants an interest in seeing the company's shares perform well, ESOP are believed to encourage participants to do what's best for shareholders.

ESOP are often linked to employee performance and offer tax incentives to the companies. The principles behind ESOP are:

- employees can take advantage of tax incentives on up to £30,000 worth of shares at any one time

- employees won’t pay Income Tax or National Insurance contributions on the difference in value between the price paid for the shares and what they’re actually worth

- employees may have to pay Capital Gains Tax if they sell the shares

- employees don’t pay Capital Gains Tax when they dispose of (before 17 March 2016) up to the first £50,000 worth of employee shares

- employees don’t pay Capital Gains Tax when they dispose of (from 17 March 2016) gains over £100,000 that are made during an individual’s lifetime; the gain is the profit or the amount that the shares have increased in value

- employees don’t pay Capital Gains Tax when they dispose of shares in employer share incentive plans (SIPs)

The Employee Share Schemes Statistics from Her Majesty’s Revenue and Customs (HMRC), covering the financial year ending 2014 and published on 30 September 2015, show there are four ESOP types (company share option plan, enterprises management incentives, save as you earn, and share incentive plan). Over this period there were 11,460 schemes operating across 4,000 companies.

Companies who do not satisfy the requirements to operate ESOP under existing tax legislation are not able to benefit from the tax advantages offered by these schemes. Those not allowed to benefit from establishing and operating ESOP include:

- closed companies (a company with no more than five controlling parties)

- companies where an employee holds a 30% or greater stake

- members of a consortium (an association of two or more companies, with the objective of participating in a common activity or pooling their resources for achieving a common goal)

Companies that operate ESOP will incur costs with the corresponding benefit received by employees. Consequently, the attributable company costs are recognised within their financial statements (this is defined as compensation of employees, which includes wages and salaries). The operating costs of ESOP can be offset against Corporation Tax and the method of recognition in the financial statements must follow the relevant accounting standards (application of accruals and matching concepts).

ESOP are considered a benefit in kind by HMRC and are therefore taxed under Income Tax. Companies that operate ESOP and benefit from the associated tax advantages must have their scheme agreed by HMRC and annually submit forms detailing the ESOP exercised price and date.

In order to improve the data quality of employee stock options within the national accounts, we have researched alternative data sources, which are discussed in section 4.

Nôl i'r tabl cynnwys4. Sources investigated

We investigated a range of potential employee stock options data sources and we identified Her Majesty’s Revenues and Customs (HMRC) as a source that had the combination of financial data and metadata required.

HMRC collects employee share option plans (ESOP) data using Form 35 (Company Share Option Plan). The data contains the market value of shares, exercised date and exercised price, as well as company registration number and Pay-As-You-Earn (PAYE) reference. Companies that distribute and provide ESOP as a benefit in kind have a statutory requirement to complete this form, otherwise fines and penalties can be enforced. As companies have to comply with accounting standards and company law (including the Corporation Tax Act 2010), HMRC’s ESOP data are deemed a high quality and reliable data source.

HMRC currently publishes statistics using Form 35 derived data in their Employee Share Schemes Statistics publication. These cover the number and nature of employee share option plan schemes in the UK.

Nôl i'r tabl cynnwys5. National accounts implementation method

For national accounts purposes, the Office for National Statistics (ONS) requires the cost of employee share options plans (ESOP) to companies and the corresponding benefit to households. The household benefit can be split between the ESOP gains and additionally any subsequent holding gains. Holding gains are the appreciation in price from holding the asset and not doing anything else that would be deemed to add value. The reason why individuals hold shares is to receive dividends or to obtain the appreciation (capital gain) in the share price. In relation to ESOP, the holding gain is therefore the appreciation in price over the period the share options could be exercised (the period the shares are held).

Option values for two dates are initially required. These are the dates when the option is granted and exercised. The option values (using these data) may need to be modelled to measure the value of the options as they accrue. This is the value before they are available to be exercised by employees.

The employee stock options values, amounts and splits could potentially supersede the current data source in the national accounts. The national accounts use quadruple-entry accounting. Therefore, to use this data, we must know not only where the uses and resources are, but also where in the economy the flow is from and to (refer to matrix section 2 in Figure 1). The data ascertained would be analysed to obtain a sector split (who is issuing the employee stock options) and further modelled to acquire holding gains. This would enable us to have a greater understanding of who issues ESOP (company and sector) and the flow of funds from each sector to employees in the households and in the case of non-resident employees, rest of the world sectors.

In the national accounts, the ESOP monetary value would be built up over time (accruing). These options would be recorded within payables (liabilities) for the company issuing the options with a corresponding asset for employees. When employees are able to exercise their options, the payable amount is replaced by an option derivative liability. This does not change the size of the liability, but re-classifies it on the national accounts balance sheet.

Nôl i'r tabl cynnwys6. Next steps

We are currently working with Her Majesty’s Revenue and Customs to determine whether access can be given to the necessary data to further our investigation into the improvement of our financial statistics in this area.

We welcome your thoughts on the contents of this article and whether there are other avenues of investigation that we should pursue.

Please contact us via email at FlowOfFundsDevelopment@ons.gov.uk or by telephone at +44 (0)1633 455787 if you have any views that you would like to share with us.

Nôl i'r tabl cynnwys7. Further Information

Flow of Funds archived background information

Financial Statistics Expert Group Minutes:

- 21 October 2014

- 22 January 2015

- 22 July 2015

- 7 December 2015 can be requested from FlowOfFundsDevelopment@ons.gov.uk

- 2 August 2016 can be requested from FlowOfFundsDevelopment@ons.gov.uk

Manylion cyswllt ar gyfer y Erthygl

Related publications

- Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) Government tables for the special data dissemination standards plus (SDDS Plus)

- Economic Statistics Transformation Programme: UK flow of funds experimental balance sheet statistics, 1997 to 2015

- Economic Statistics Transformation Programme: Flow of funds - the international context

- Economic Statistics Transformation Programme: Developing the enhanced financial accounts (UK Flow of Funds)

- Economic Statistics Transformation Programme: the UK flow of funds project: identifying sectoral interconnectedness in the UK economy

- Economic Statistics Transformation Programme: The UK Flow of Funds Project: Improvements to the Sector and Financial Accounts

- Economic Statistics Transformation Programme: Historical estimates of financial accounts and balance sheets

- Economic Statistics Transformation Programme: The UK Flow of Funds Project - comprehensive review of the UK financial accounts

- Economic Statistics Transformation Programme: The UK Flow of Funds Project: introduction, progress and future work