1. Main points

The UK spent £483 billion on social protection in 2013, equivalent to 28% of GDP

In the UK in 2013, nearly three quarters of social protection expenditure was on old age and sickness

Between 2008 and 2013, the number of male old age beneficiaries rose 16.0% while the number of female old age beneficiaries fell by 0.2% in the UK

In 2013, expenditure on disability social protection in the UK fell in real terms by £392 per recipient

In 2013, the UK maintained its position among the selected countries as the highest spender on housing social protection (£394 per capita)

2. International comparisons

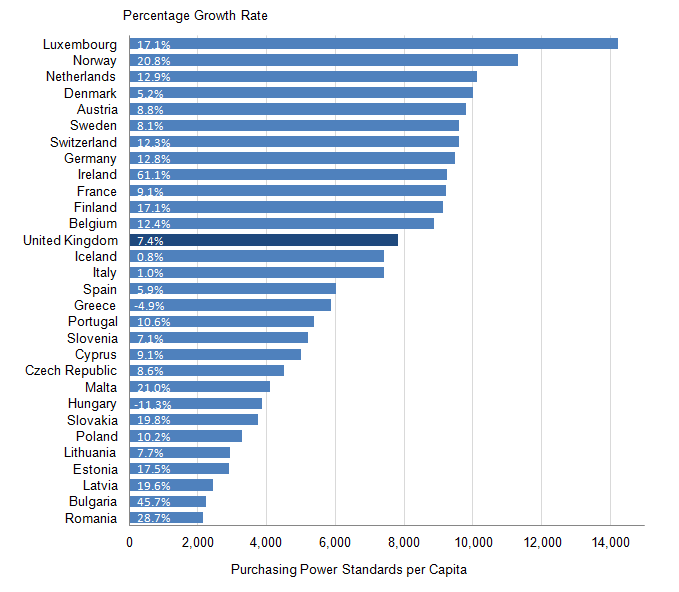

Figure 1 compares social protection expenditure per capita in 2013 internationally1. Expenditure is measured in purchasing power standards (PPS). This is an artificial currency unit used for international comparisons. One PPS will, in theory, buy exactly the same amount in each country at a common point in time.

Where data availability permits, the percentage growth in social protection provision since 2007 is also given. To aid meaningful comparison, the effects of price change are excluded from these percentages.

Figure 1: International Comparisons of Social Protection Expenditure per Capita in 2013, and Growth from 2007 to 2013

UK

Source: Eurostat

Notes:

- Data for 2013 were not available for Denmark, Ireland, Greece, Netherlands, Poland, Romania, and Iceland. For these seven countries, 2012 estimates of PPS expenditure have been used.

- Turkey, Croatia and Serbia are not included for reasons of data availability.

Download this image Figure 1: International Comparisons of Social Protection Expenditure per Capita in 2013, and Growth from 2007 to 2013

.png (30.9 kB) .xls (28.7 kB)The average growth in national expenditure per capita in this period was 13.4%2. Hungary and Greece were the only countries who reported a decline in the level of real terms social protection available to their inhabitants. At 61.1%, Ireland’s growth in social protection expenditure per capita was the highest by some way3. It was more than one third higher than that of Bulgaria which is ranked second with growth of 45.7%. Only 3 other countries – Norway, Malta and Romania – had growth of 20% or higher. During this period, the UK’s growth in expenditure was 7.4% - only 7 out of the 30 countries for which data are available reported lower expenditure growth.

In the most recent year for which data are available, the highest spending country was Luxembourg with expenditure of 14,226 PPS per capita. However, Luxembourg is an unusual case given the high proportion of its workforce that is non-resident. Norway had the second largest with expenditure of 11,310 PPS per capita, 45.1% higher than that of the UK. Only 2 other countries - the Netherlands and Denmark - had expenditure that exceeded 10,000 PPS per capita.

The UK was thirteenth in terms of the amount spent. The UK’s expenditure on social protection was 7,795 PPS per capita in 2013 - 15.3% above the average of the 30 countries for which data were available. It is of interest to compare the UK’s position with the three other G74 members among the selected countries. The UK’s expenditure was lower than Germany and France which were 9,469 PPS per capita (21.5% above the UK) and 9,223 per capita (18.3% above the UK), respectively. Italy, on the other hand, spent 7,614 PPS per capita on social protection, 4.9% less than the UK.

Notes for international comparisons

Eurostat give a more complete definition: Social protection encompasses interventions from public or private bodies intended to relieve households and individuals of the burden of a defined set of risks or needs, provided that there is neither a simultaneous reciprocal nor an individual arrangement involved.

For reasons of data availability, Croatia, Serbia and Turkey are not used in the calculation of this average.

The data for Ireland may be revised at a later date.

The G7 is a group of the seven major advanced economies as reported by the International Monetary Fund. Its members are France, Germany, Italy, United Kingdom, Canada, Japan and the USA.

3. Social protection spending in the UK

Social protection benefits can either be in cash or in kind. Benefits in kind include hospital stays, free school dinners and home care. In 2013, the latest year for which data are available, over £482 billion was spent on social protection in the UK, an increase of 1.7% on the previous year and equivalent to 28% of GDP.

Table 1: Social Protection Expenditure in the United Kingdom in 2012 and 2013

Download this table Table 1: Social Protection Expenditure in the United Kingdom in 2012 and 2013

.xls (25.1 kB)As can be seen from Table 1, cash benefits accounted for approximately £292 billion, or 60.5%, of social protection. The remaining benefit in kind expenditure was over £190 billion, or 39.5% of the total. At 2.0%, the increase in spending on benefits in kind was 0.5 percentage points higher than that of cash benefits (1.5%).

Under the ESSPROS system, social protection expenditure is divided into 8 broad categories. Figure 2 illustrates the proportion of total spend accounted for in these 8 categories in 2013. For the sake of clarity 3 of these categories – Social Exclusion not elsewhere classified, Unemployment and Survivors have been recorded in a single "Other" category. Each of these 3 accounted for less than 3% of expenditure.

Figure 2: United Kingdom Social Protection Expenditure by Category, 2013

Source: Eurostat

Notes:

Download this chart Figure 2: United Kingdom Social Protection Expenditure by Category, 2013

Image .csv .xlsThe remainder of this article will concentrate on the ESSPROS categories of Old Age, Disability and Housing. The international comparison within these categories should be interpreted with caution, as the recipients of benefits under one of these categories are likely also to receive benefits under other categories. For example, pensioners in a country that spends less than the average on social protection in the old age category might, in fact, enjoy more social protection if, for example, their country provides free healthcare.

Nôl i'r tabl cynnwys